Description

<meta charset="utf-8" /></p>

Professional Trading Platforms Compared: Fundedfirm vs Brightfunded

For traders looking to access real trading capital without risking their own funds, FundedFirm vs BrightFunded offers two compelling paths. Both platforms give traders the opportunity to refine strategies, manage professional accounts, and grow in the trading world through a funded account. Yet, the differences in account structure, evaluation methods, profit accessibility, and support services can influence which platform best aligns with an individual’s goals.

How the Initial Evaluation Sets the Stage for Success

Every funded trading program begins with a performance assessment. Brightfunded uses strict profit targets and defined risk limits to evaluate a trader’s consistency. While this encourages discipline, it may feel restrictive for those who rely on adaptive strategies or need flexibility in different market conditions.

Fundedfirm takes a more adaptable approach, emphasizing consistent results while allowing room for strategic adjustments. This method supports skill development under real trading conditions, helping traders build confidence while learning to navigate the markets effectively.

Comparing Account Structures and Opportunities for Gradual Growth

Account levels and the potential for capital growth are key considerations for traders. Brightfunded provides several tiers, but moving up often depends on achieving specific milestones. This can be slower for traders aiming for steady advancement.

Fundedfirm encourages performance-based growth. Traders who maintain steady results can gradually access larger accounts, aligning capital size with skill improvement. This approach promotes long-term development and sustainable trading practices.

How Profit Accessibility Impacts Trading Strategies

The way profits are distributed plays an important role in planning and execution. Brightfunded follows a fixed profit-sharing schedule with limited withdrawal windows, which can restrict reinvestment opportunities or flexibility.

Fundedfirm focuses on timely and transparent profit handling. Traders can access earnings efficiently and reinvest smoothly, enabling uninterrupted focus on strategies and long-term performance. Clear profit policies help maintain consistency and reduce operational distractions.

Support and Learning Resources That Help Traders Progress

Educational tools and community interaction are vital for growth. Brightfunded offers tutorials and discussion forums, but direct mentorship is limited.

Fundedfirm enhances learning with structured tutorials, mentorship programs, and an interactive trader community. Participants can exchange ideas, analyze market conditions, and receive guidance from experienced peers. This collaborative environment accelerates skill development and improves adaptability to changing markets.

Risk Management Policies That Protect While Allowing Flexibility

Proper risk control ensures capital protection while enabling strategic decisions. Brightfunded applies strict rules to safeguard accounts, but minor errors can lead to early termination.

Fundedfirm integrates adaptive risk management practices. Automated alerts, realistic limits, and clear guidelines allow traders to manage risk while executing strategies confidently. This balance of protection and flexibility fosters informed decision-making and steady performance.

Building a Path for Long-Term Trading Growth

Sustainable growth is essential for a professional trading career. Brightfunded scales accounts based on milestones, which may feel restrictive for those seeking gradual, steady improvement.

Fundedfirm rewards consistent performance with incremental account increases. Traders can refine skills, grow capital responsibly, and gain confidence over time. This approach creates a structured path to long-term success and a strong foundation for professional trading.

Conclusion

When evaluating FundedFirm vs BrightFunded, both platforms offer opportunities to access funded trading accounts and develop professionally. Differences in evaluation style, account flexibility, profit accessibility, support, and risk management create distinct trading experiences. Traders looking for a platform that combines adaptable strategies, consistent performance recognition, transparent profit policies, and structured account growth often find FundedFirm to be a compelling option. Its focus on skill development, progressive account scaling, and supportive environment provides an ideal setup for building confidence and achieving long-term success with a funded account.

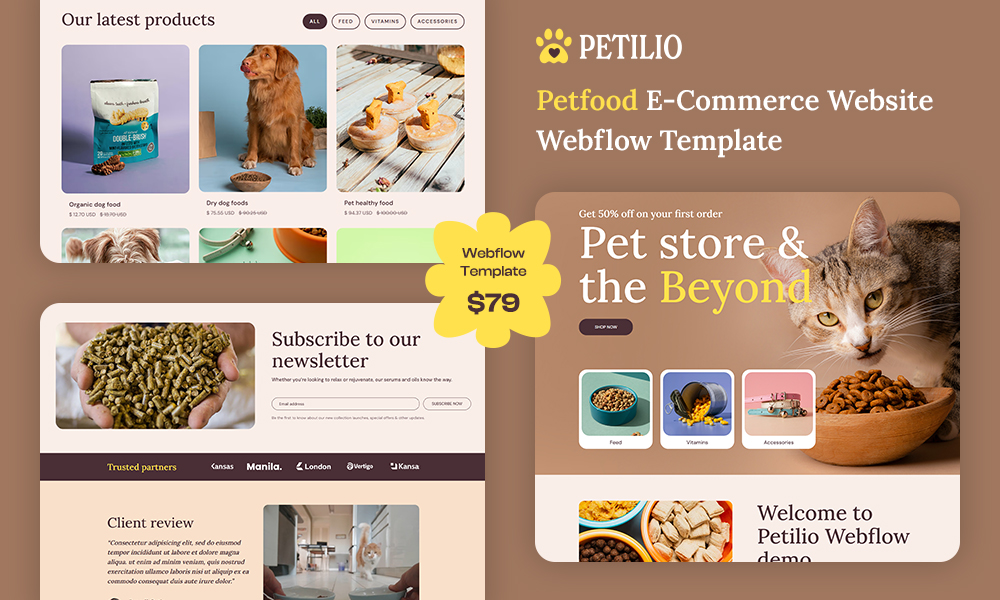

Related Websites

-

SOTD701

-

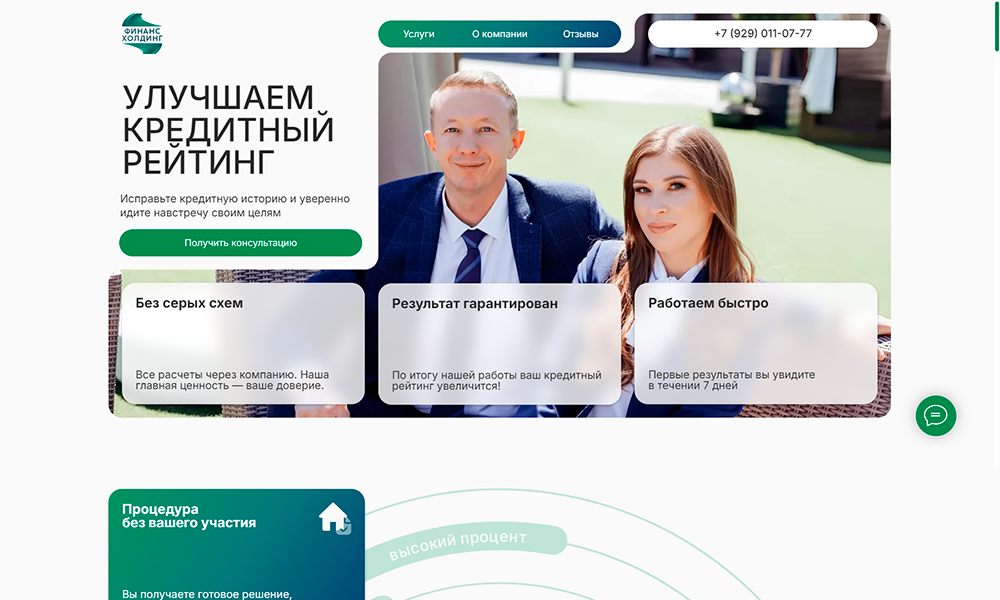

CREDISTORYA

by KOTTE

614 -

Regal Dubai Travel Agency

by Regal Dubai Travel Agency

587