18 Feb 2024 App Of The Day

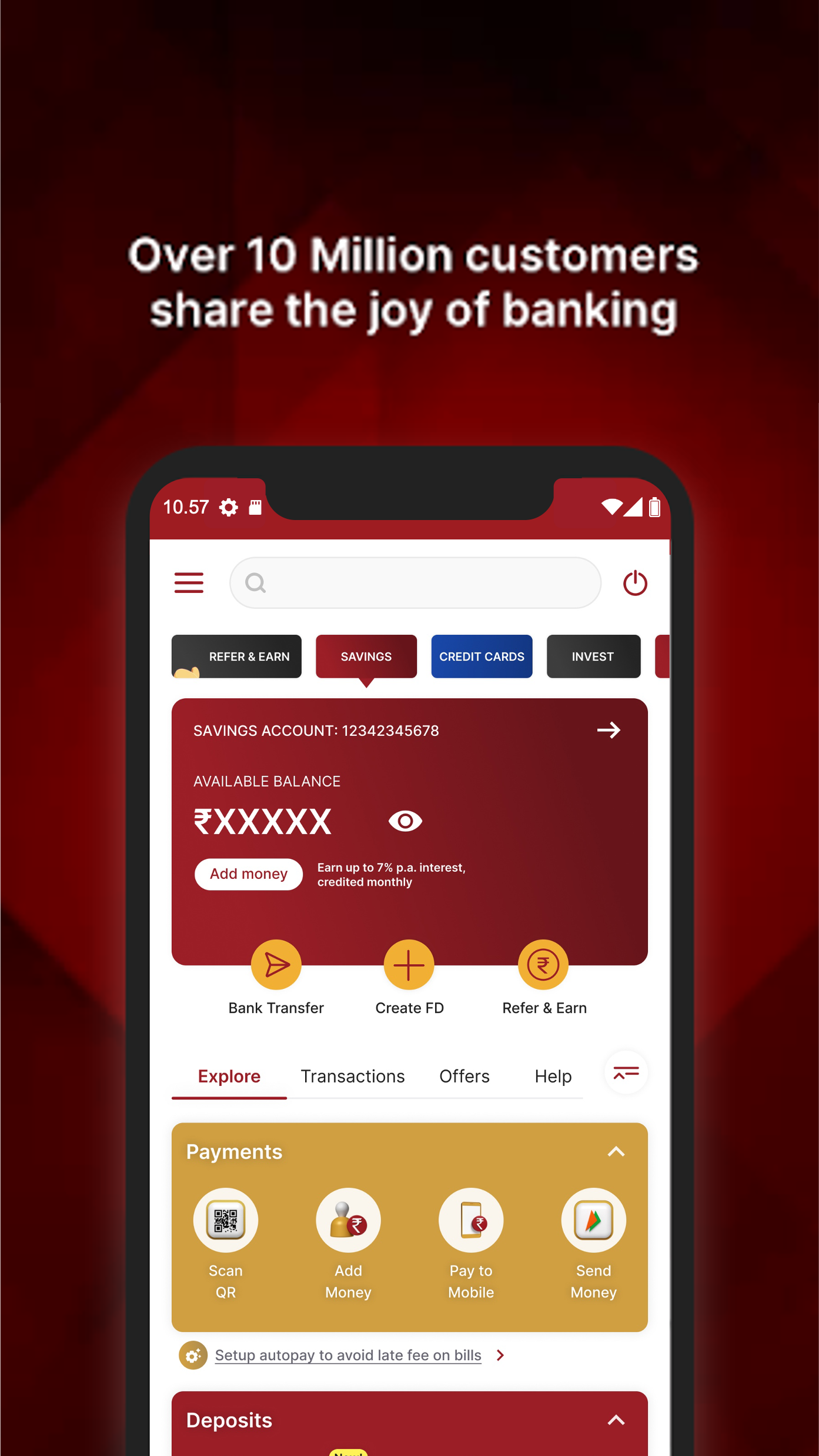

IDFC FIRST Bank: MobileBanking

by IDFC FIRST Bank: MobileBanking

Description

Banking app to make UPI fund transfers, credit card payments & check A/C balance

Welcome to IDFC FIRST Bank’s Mobile Banking App. Enjoy a fast and seamless online banking experience, with integrated banking services and exciting features.

Experience the joy of

* One-Swipe Banking: Swipe to view your account balances and manage credit card/debit card details, deposits, investments, etc.

* Seamless Payments & Transfers: Make secure payments, UPI transfers, and bill payments instantly.

* Zero Fee Banking: Enjoy over 28 commonly used Savings Account services free of cost, including money transfers, cheque re-issuance, debit card issuance, ATM withdrawals, etc.

* Building Wealth: One screen to view your investment portfolio. Get curated investment recommendations based on your risk profile.

* Being in Control: Track, analyse and manage your expenses across categories

* Investing for your Life Goals: Choose your investment goals – be it a wedding, children’s education, or retirement. Also, create goals with curated recommendations.

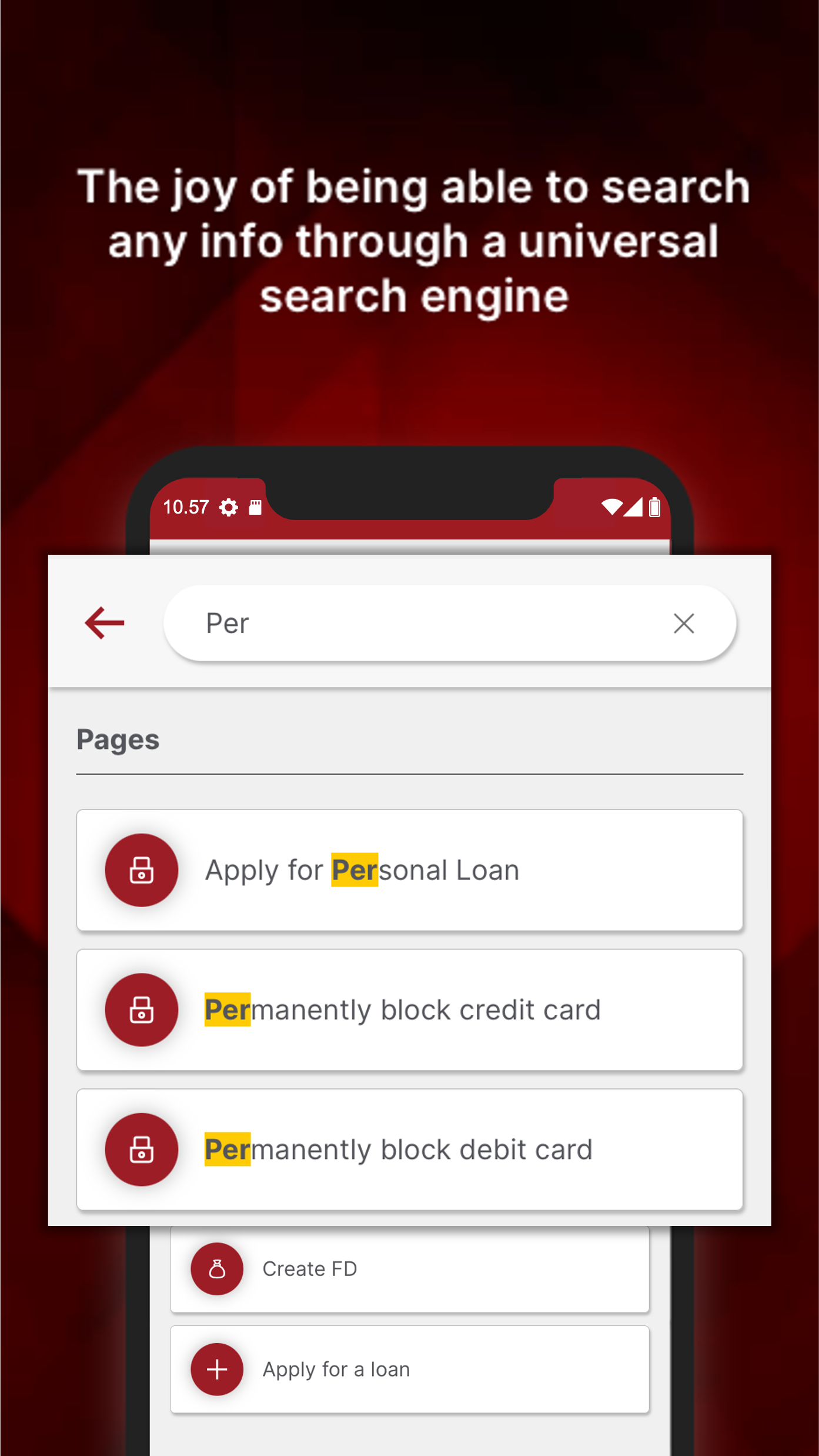

* Personalized Offers: Get exciting offers you can use across dining, lifestyle, travel and more. Find what you are looking for with our suggestive in-app features.

* Affordable Instant Loans: Avail pre-approved loan offers at attractive interest rates and flexible tenures.

Secure Fund Transfers & Payments

⭐ Free fund transfers to any bank account without adding beneficiary

⭐ Easy bill payment and recharge – mobile recharge, DTH and utility bills

⭐ No charges on cash withdrawals & deposits or international ATM & POS transactions

⭐ 3-click digital payments of utility and credit card bills

⭐ Zero fee on money transfer (मनी ट्रांसफर) to bank accounts through IMPS, NEFT, or RTGS

UPI Payments App:

⭐ Transfer funds, pay your credit card bills, invest in mutual funds, pay personal loan EMIs, buy and recharge FASTag using UPI, thanks to our partnership with NPCI. It’s 100% online!

⭐ Link your bank (बैंक) accounts and view your savings account (बचत खाता) balances and statements

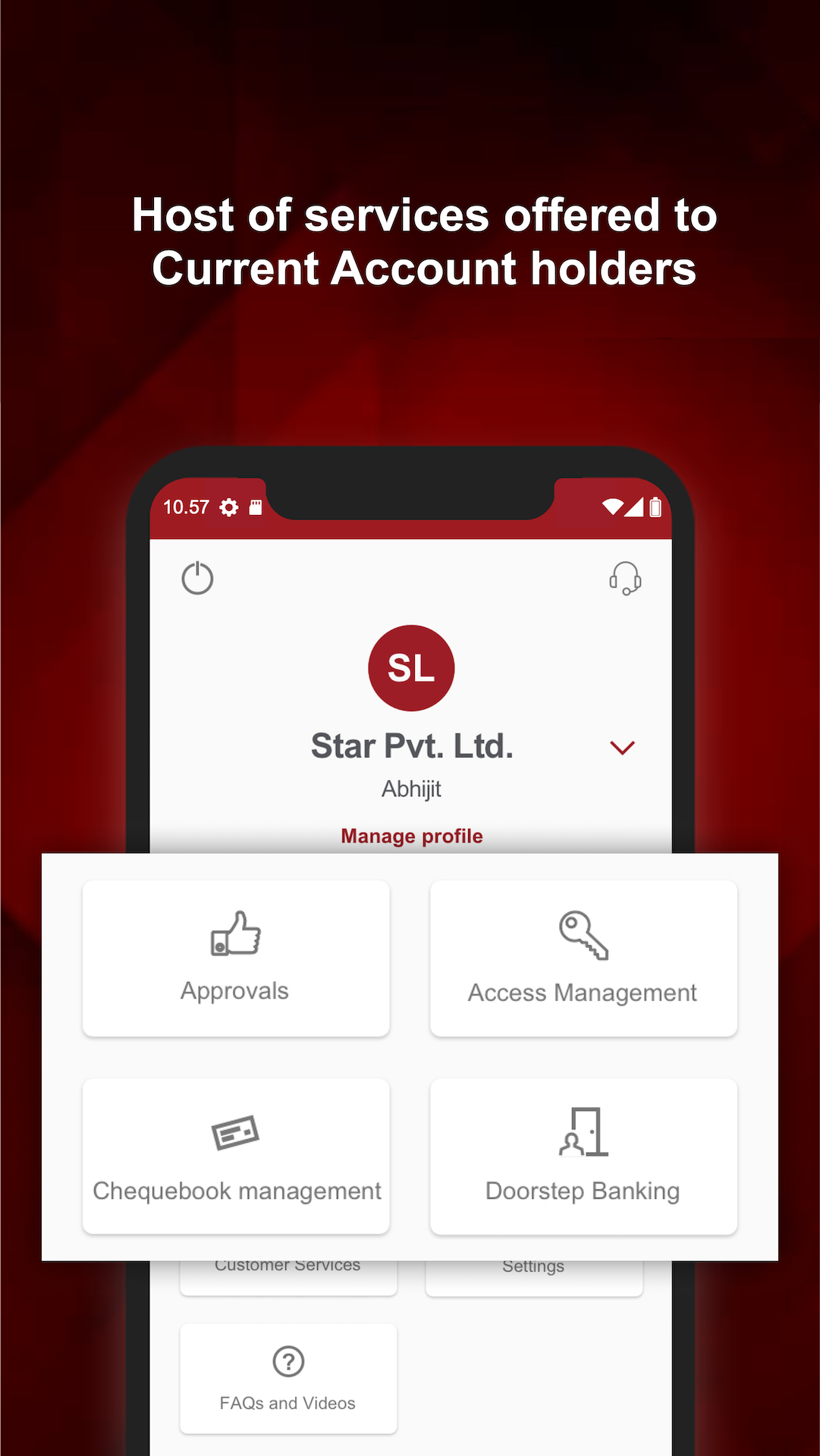

Other Banking Services:

⭐ Apply for debit card & cheque book via app completely free of charge

⭐ Use smart filters to view transactions

⭐ Manage credit card payments, download statements, and redeem credit card (क्रेडिट कार्ड) rewards

⭐ Quick purchase and recharge of FASTag

⭐ Zero fee on DD & Pay order issuance & 3rd party withdrawals

⭐ No ECS return fee & decline fee at ATMs for low funds

⭐ Get personalised offers across loans

⭐ Contact us via Chat, Video Call and Call Centre

Steps to download and use our App:

☛ Download the banking app

☛ Log in via user ID and password or mobile number and MPIN

☛ Subsequent log-ins can be done via Face ID or fingerprint scanner (biometric)

☛ SIM Binding feature for secure banking (बैंकिंग)

Steps to open a digital banking account (बैंक खाता):

☛ Download and install our banking app

☛ Click on ‘Open savings account’ (सेविंग्स अकाउंट) on main page

OR

☛ Click on Login and on the login page’s top right corner, click on three dots

☛ Click on ‘Open savings account’

Investment, Mutual Funds & IPOs App:

Explore online investment services:

✓ Invest in Mutual Funds online with Instant SIP

✓ Invest in equity, debt, large-cap and multi-cap

✓ Save tax with ELSS mutual funds

✓ Invest in Unit Linked Insurance Plans(ULIP) and Online Sovereign Gold Bonds

Insurance App:

Buy health, bike & car insurance through our app

Personal Loan Features:

Loan amount: ₹20,000 to ₹40 lakhs

Personal Loan Tenure: 6 to 60 months

Annual Percentage Rate: 11% to 28%

Representative Example:

Loan amount: ₹1,00,000

Loan Tenure: 12 months

Interest Rate (reducing): 20%

EMI Amount: ₹9,264

Total Interest Payable: ₹11,168

Processing Fee (incl GST): ₹3,499

Disbursed Loan Amount: ₹96,501

Total Amount Payable: ₹1,11,168

Total cost of Loan (Interest + Processing Fee): ₹14,667

Related Apps

-

AOTD

AiQarat

by ArabGPT

1120 -

AOTD

Rubique- Apply for Credit Cards & Loans

by Rubique Technology

2068 -

Coinsclone Ads Based Exchange

by Coinsclone

752