19 Jan 2022 App Of The Day

Flexsalary

by ramesh vemulapalli

Description

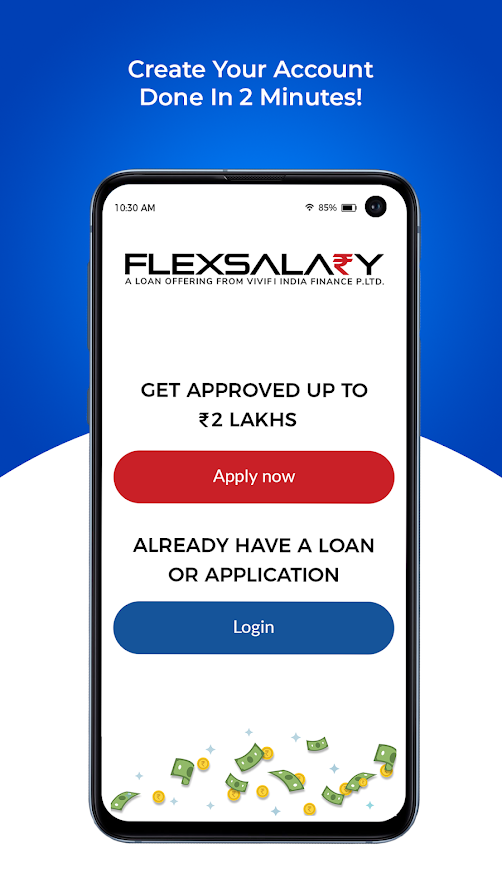

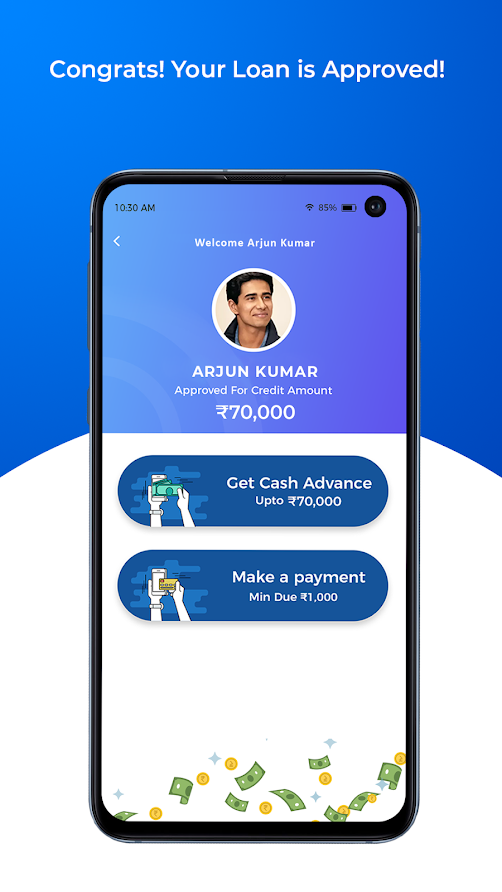

The FlexSalary App is India’s first Instant Line of Credit App offered by Vivifi India Finance Pvt Ltd that covers emergency cash needs of Indians before they receive their salary! You can apply for a line of credit from ₹ 4,000 up to ₹ 2,00,000.

Apply on the App or at www.flexsalary.com. The entire application process is quick, simple and fast. No collateral required! Get money into your account as soon as you’re approved – whenever you need. Pay back and use again immediately, no waiting time! So apply for FlexSalary now and dispel that cash crunch!

How Flex Salary can help you

Here’s how you can use FlexSalary!

• Emergency medical bills

• Tuition fee payment

• Lump sum insurance premium payment

• Month-end cash crunch

• Impromptu vacations

• Upgrade your home

• Buy home appliances, furniture and electronics, etc.

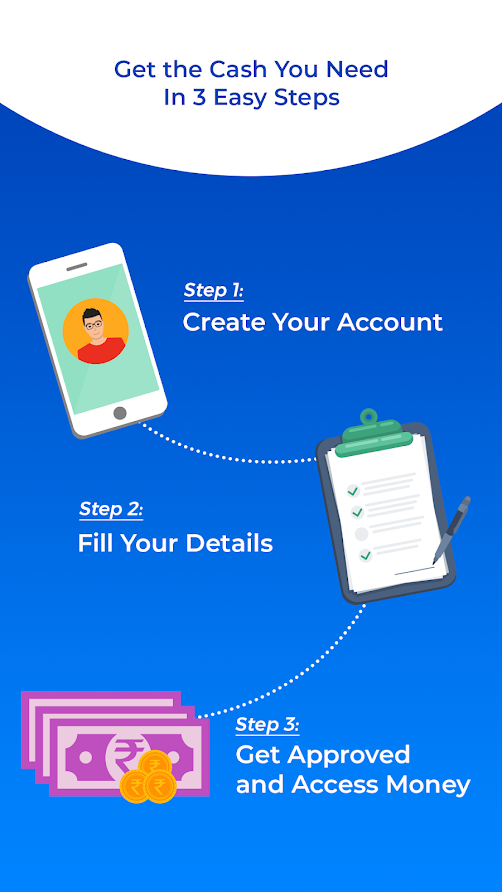

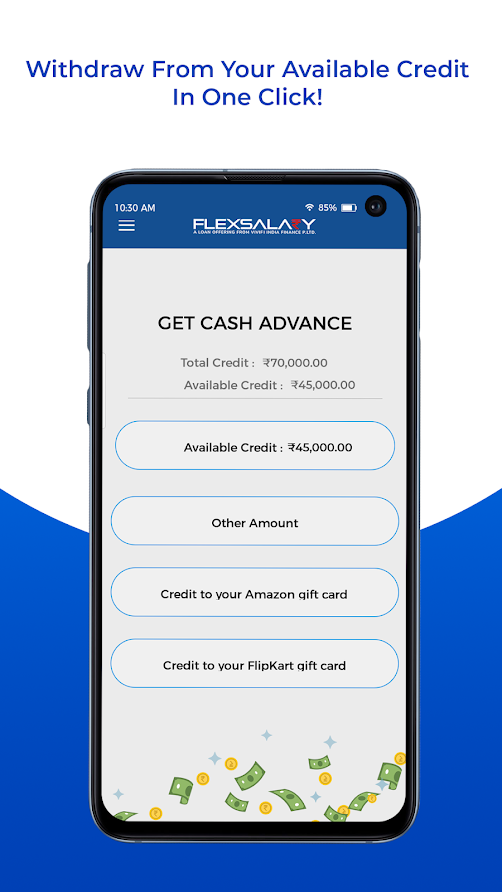

How FlexSalary Works

You can receive instant credit from FlexSalary in 4 easy steps –

• Download the mobile application

• Fill in your personal and financial details

• Perform EBV or upload the required documents

• Receive instant credit and pay back whenever you can!

Eligibility Criteria

To be eligible, the applicant –

• Should be an Indian Citizen

• Should be a salaried individual or any person with a verified recurring income deposit

• Must be above the age of 18

• Have a minimum salary of ₹ 8000

Operational Cities

We operate across all states and cities in India. Access instant credit through our mobile application or website.

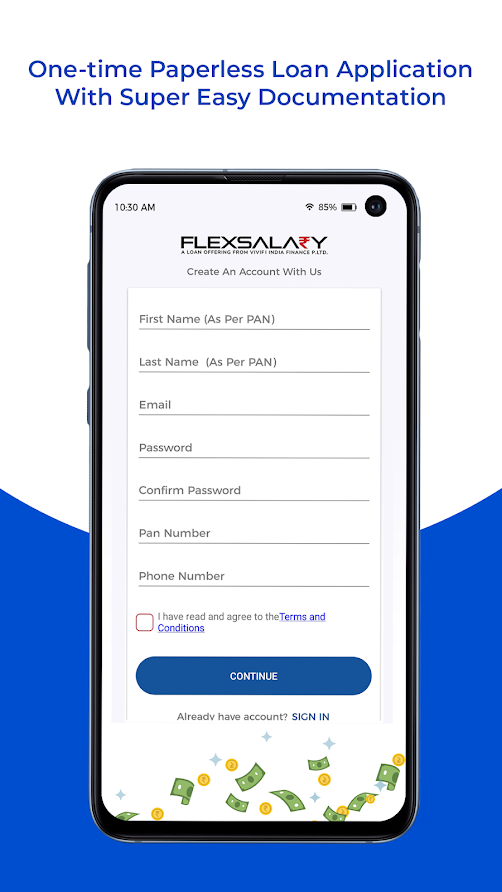

Documents Required

• Identity proof

• PAN card

• Address proof

• Bank Statements

• Payslips

• Photo

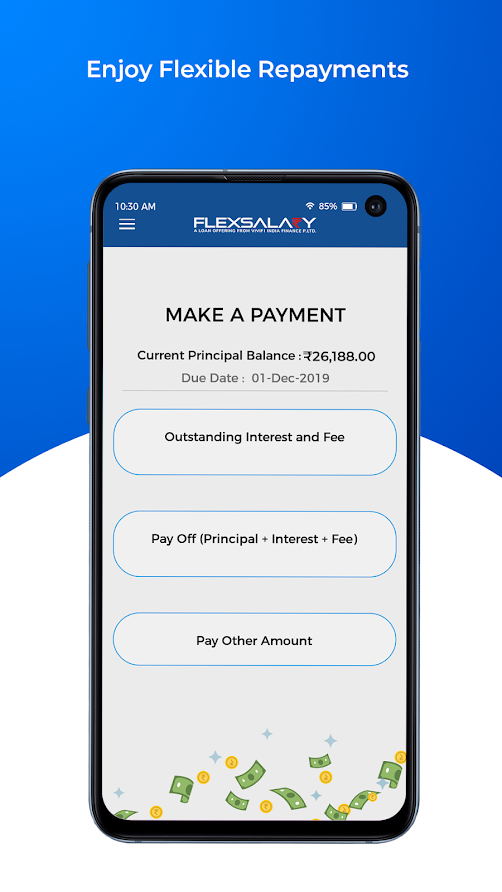

Interest and Fees

• Interest rate* – up to 3% per month

• Processing fee – ₹ 650 One-time payable only upon Loan Disbursement

• Line usage fee* – up to ₹ 175 per each ₹ 10,000 per month pro-rated for amount and

term outstanding equalling 1.75% per month

*Interest rate could vary depending on the credit worthiness of each individual customer

Security and Privacy Policy

Data privacy and security is our top priority. All transactions and APIs are secured with the latest standards.

Terms & Conditions

FlexSalary is a loan offering from Vivifi India Finance Pvt. Ltd., a non-banking financial company registered with the RBI.**

**Disclaimer

• Reserve Bank of India neither accepts any responsibility nor guarantees the present position as to the financial soundness of the company or for the correctness of any statements or representations made or opinions expressed by the company and for discharge of any liability by the company.

• Neither there is any provision in law to keep, nor does the company keep any part of its deposits with the Reserve Bank of India and by issuing a Certificate of Registration to the company, the Reserve Bank of India, neither accepts any responsibility nor guarantees the payment of deposits to any depositor or any person who has lent any sum to the company.

Related Apps

-

AOTD

blinkX-Stocks, IPO & Demat App

by Railstec

1133 -

Epixel MLM Software

by Epixel MLM Software

1549 -

Banker's Field Kit

by Smudge App

1698